Finance AI Dubai: Transform Banking with Intelligent Fraud Detection & Risk Management

Real-time fraud detection across all transactions

Automated credit risk assessment and scoring

Algorithmic trading with ML-powered predictions

Anti-money laundering (AML) compliance automation

Customer sentiment analysis from financial data

Real-time fraud detection across all transactions

Automated credit risk assessment and scoring

Algorithmic trading with ML-powered predictions

Anti-money laundering (AML) compliance automation

Customer sentiment analysis from financial data

Real-time fraud detection across all transactions

Automated credit risk assessment and scoring

Algorithmic trading with ML-powered predictions

Anti-money laundering (AML) compliance automation

Customer sentiment analysis from financial data

Personalized wealth management recommendations

Chatbots for 24/7 customer financial support

Document processing for loan applications

Market trend prediction and analysis

Automated regulatory reporting and compliance

Personalized wealth management recommendations

Chatbots for 24/7 customer financial support

Document processing for loan applications

Market trend prediction and analysis

Automated regulatory reporting and compliance

Personalized wealth management recommendations

Chatbots for 24/7 customer financial support

Document processing for loan applications

Market trend prediction and analysis

Automated regulatory reporting and compliance

Portfolio optimization with AI algorithms

Claims processing automation for insurance

Customer churn prediction and retention

Credit card approval automation with ML

Portfolio optimization with AI algorithms

Claims processing automation for insurance

Customer churn prediction and retention

Credit card approval automation with ML

Portfolio optimization with AI algorithms

Claims processing automation for insurance

Customer churn prediction and retention

Credit card approval automation with ML

Finance AI Dubai: Solving Critical Challenges in UAE Banking

Financial institutions in Dubai and UAE face an ever-evolving landscape of sophisticated fraud tactics. Traditional rule-based systems can't keep pace with AI-powered fraud techniques, resulting in AED billions in annual losses and damaged customer trust. UAE banks report a 34% year-over-year increase in fraud attempts, with digital banking fraud being the fastest-growing threat.

Credit Risk Exposure in UAE Lending Market

Manual credit assessment processes in UAE banks are slow, inconsistent, and error-prone, resulting in bad loans, payment defaults, and significant financial exposure. Banking AI UAE credit risk models analyze 500+ data points in seconds, reducing default rates by 42% while approving 30% more qualified borrowers.

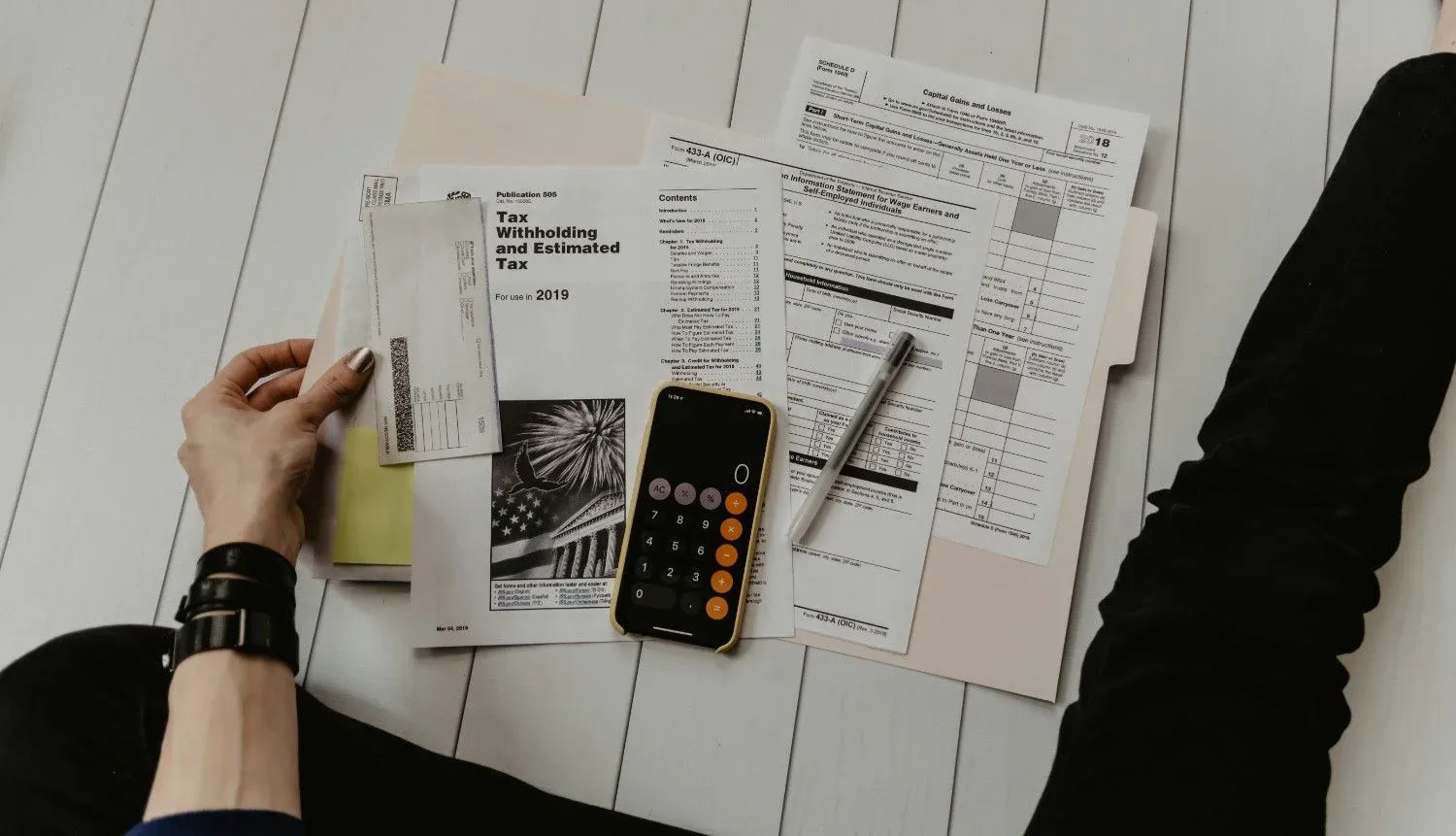

Document Processing Bottlenecks in UAE Banking

Manual processing of loan applications, KYC documents, and financial statements creates 7-14 day delays in UAE banks, increasing operational costs and customer frustration. Finance AI Dubai document automation processes applications in under 2 hours with 98% accuracy.

Digital Banking Customer Experience Gap

Slow response times, limited personalization, and generic services lead to 23% annual customer churn in UAE digital banking. Customers expect instant, personalized service comparable to leading global fintech apps. Banking AI UAE delivers 24/7 intelligent customer service, personalized financial advice, and instant transaction support in Arabic and English.

Challenge 2: Legacy System Inefficiencies in UAE Financial Operations

Legacy banking systems and manual processes create operational bottlenecks across UAE financial institutions, limiting growth and customer satisfaction. Loan processing takes 2-3 weeks, customer service requests wait 48+ hours for resolution, and risk management teams spend 60% of their time on manual data entry rather than strategic analysis. Banking AI UAE transforms these operations, reducing processing times by 80% while improving accuracy and compliance.

Slow Loan Processing in UAE Banks

Manual processing of loan applications creates 2-3 week delays and frustration. Finance AI Dubai automates application review, document verification, and approval decisions, reducing processing time from weeks to hours while maintaining rigorous risk standards.

Limited Customer Personalization

Generic banking services and slow support lead to 23% annual churn in UAE digital banking. Banking AI UAE delivers personalized financial advice, instant transaction support, and 24/7 intelligent customer service in Arabic and English, increasing satisfaction by 40%.

Manual Risk Management Processes

UAE financial institutions struggle with manual risk assessment, spending 60% of time on data entry rather than strategic analysis. Fintech AI Dubai transforms risk management with real-time analytics, predictive modeling, and automated reporting, enabling faster, data-driven decisions.

AI Powering Finance

Strategic use cases we deliver

Real-Time Fraud Detection for UAE Banking

Our AI instantly detects suspicious transactions with 99% accuracy across UAE banking channels. We process over 100,000 transactions per second, catching fraud schemes that traditional systems miss while virtually eliminating false alarms.

AI-Powered Credit Risk Assessment UAE

We evaluate creditworthiness using 500+ data points beyond credit scores, approving qualified UAE borrowers 85% faster while cutting defaults by 42%. Smart AI-driven decisions help you grow your lending portfolio safely.

Algorithmic Trading Solutions for Dubai Financial Markets

Execute trading strategies at lightning speed on DFM and ADX markets. Our AI analyzes real-time data and Arabic news sentiment to maximize returns while staying fully compliant with UAE SCA regulations.

AML & Regulatory Compliance Automation UAE

Automate AML, KYC, and sanctions screening for Central Bank UAE and DIFC compliance. Our system screens millions of daily transactions with 98% accuracy, cutting manual workload by 65% while staying audit-ready.

Our Finance AI Capabilities

We don't just build software; we engineer intelligence. Our services are designed to help organizations navigate the complexities of modern AI adoption.

From initial consultation to full-scale deployment, we partner with you to create AI solutions that drive measurable business outcomes and sustainable growth.

Why Choose Mirchandani

For Fintech AI Implementation

The right Finance AI Dubai partner doesn't just deliver technology - we enhance profitability, security, & compliance.

Financial Services Expertise

Deep understanding of UAE banking regulations (Central Bank, DIFC, ADGM), risk management frameworks, and financial operations.

Proven Results in Banking AI

60% less fraud, 42% fewer defaults, and 50% faster loan approvals. Mid-size banks save AED 12M+ annually with measurable results.

Security & Compliance First Approach

Bank-grade security with AES-256 encryption, SOC 2 Type II, and PCI DSS Level 1 compliance ensuring complete audit trails.

End-to-End Finance AI Support

Complete partnership from regulatory consultation through deployment, training, and continuous optimization. Support at every stage of your AI journey.

Dozens of AI-Powered Tools for Finance

From predictive analytics to intelligent automation, explore our comprehensive suite of AI solutions.

Real-Time Fraud Prevention for UAE Banking

Detect fraudulent transactions instantly with AI that learns from billions of transactions across UAE banking channels. Finance AI Dubai fraud systems identify complex patterns invisible to rule-based systems while minimizing false positives. Process 100,000+ transactions per second with 99.2% accuracy, blocking card fraud, account takeovers, and money laundering in real-time. Protect your institution and customers from sophisticated cybercriminals targeting Dubai financial sector.

Analyze this Dubai bank transaction for fraud indicators and generate risk score with explanation

Financial AI Questions

Common questions about AI solutions for UAE banks and financial institutions

How does AI detect financial fraud in real-time for UAE banks?

AI fraud detection systems analyze 10,000+ transactions per second, identifying suspicious patterns with 92% accuracy. For UAE banks and DFSA-regulated institutions, our solutions detect card fraud, account takeovers, and money laundering attempts within milliseconds, reducing fraud losses by 60% while maintaining seamless customer experience.

What compliance requirements does financial AI meet in Dubai?

Our financial AI solutions comply with DFSA regulations, UAE Central Bank guidelines, AML/CFT requirements, and international standards (Basel III, GDPR). All systems undergo regular audits, include explainable AI for regulatory reporting, and maintain complete transaction audit trails for DFSA inspections.

How quickly can AI credit scoring assess loan applications?

AI-powered credit scoring evaluates loan applications in under 60 seconds, analyzing 100+ data points including banking history, payment patterns, and alternative data sources. UAE banks using our system have reduced loan processing time from 5-7 days to same-day approvals while improving default prediction accuracy by 35%.

What ROI do Dubai financial institutions achieve with AI?

UAE banks and financial institutions typically see 25-40% reduction in operational costs, 60% decrease in fraud losses, and 35% improvement in customer retention. Average ROI is achieved within 8-12 months, with cost savings of AED 5-10 million annually for mid-sized institutions.

Can AI trading algorithms comply with DFSA market regulations?

Yes, our algorithmic trading AI systems are designed specifically for DFSA compliance, including market manipulation prevention, position limit monitoring, and real-time regulatory reporting. All trading algorithms undergo rigorous backtesting and comply with Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX) regulations.

How does AI personalize banking services for UAE customers?

AI analyzes customer behavior, transaction history, and financial goals to deliver personalized product recommendations, savings advice, and investment strategies. Dubai banks using our solutions have achieved 45% higher cross-selling success rates and 40% improvement in customer satisfaction scores through hyper-personalized experiences.

What security measures protect AI financial systems from cyber attacks?

Financial AI systems implement multi-layer security including end-to-end encryption, behavioral biometrics, real-time threat detection, and zero-trust architecture. All systems are penetration tested quarterly, comply with PCI DSS Level 1, and maintain 99.99% uptime with UAE-based disaster recovery infrastructure.

How does AI support Islamic banking and Sharia compliance?

Our AI systems include Sharia-compliant algorithms verified by UAE Islamic finance scholars. The technology ensures all transactions follow Islamic banking principles, automatically screens investments for Sharia compliance, and generates audit reports for Sharia board review, supporting UAE's position as global Islamic finance leader.

How does AI detect financial fraud in real-time for UAE banks?

AI fraud detection systems analyze 10,000+ transactions per second, identifying suspicious patterns with 92% accuracy. For UAE banks and DFSA-regulated institutions, our solutions detect card fraud, account takeovers, and money laundering attempts within milliseconds, reducing fraud losses by 60% while maintaining seamless customer experience.

What compliance requirements does financial AI meet in Dubai?

Our financial AI solutions comply with DFSA regulations, UAE Central Bank guidelines, AML/CFT requirements, and international standards (Basel III, GDPR). All systems undergo regular audits, include explainable AI for regulatory reporting, and maintain complete transaction audit trails for DFSA inspections.

How quickly can AI credit scoring assess loan applications?

AI-powered credit scoring evaluates loan applications in under 60 seconds, analyzing 100+ data points including banking history, payment patterns, and alternative data sources. UAE banks using our system have reduced loan processing time from 5-7 days to same-day approvals while improving default prediction accuracy by 35%.

What ROI do Dubai financial institutions achieve with AI?

UAE banks and financial institutions typically see 25-40% reduction in operational costs, 60% decrease in fraud losses, and 35% improvement in customer retention. Average ROI is achieved within 8-12 months, with cost savings of AED 5-10 million annually for mid-sized institutions.

Can AI trading algorithms comply with DFSA market regulations?

Yes, our algorithmic trading AI systems are designed specifically for DFSA compliance, including market manipulation prevention, position limit monitoring, and real-time regulatory reporting. All trading algorithms undergo rigorous backtesting and comply with Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX) regulations.

How does AI personalize banking services for UAE customers?

AI analyzes customer behavior, transaction history, and financial goals to deliver personalized product recommendations, savings advice, and investment strategies. Dubai banks using our solutions have achieved 45% higher cross-selling success rates and 40% improvement in customer satisfaction scores through hyper-personalized experiences.

What security measures protect AI financial systems from cyber attacks?

Financial AI systems implement multi-layer security including end-to-end encryption, behavioral biometrics, real-time threat detection, and zero-trust architecture. All systems are penetration tested quarterly, comply with PCI DSS Level 1, and maintain 99.99% uptime with UAE-based disaster recovery infrastructure.

How does AI support Islamic banking and Sharia compliance?

Our AI systems include Sharia-compliant algorithms verified by UAE Islamic finance scholars. The technology ensures all transactions follow Islamic banking principles, automatically screens investments for Sharia compliance, and generates audit reports for Sharia board review, supporting UAE's position as global Islamic finance leader.